Access to affordable and reliable energy enables growth of local economies. And demand for energy ensures feasibility of business models for decentralised energy solutions such as mini-grids. Demand is not necessarily automatic, and an important part of demand stimulation is through productive uses of energy (PUE): using energy to increase income and productivity. But many communities need additional support to establish PUE more quickly, and financing is a key barrier for scaling PUE. Women especially face socio-cultural barriers that hinder PUE.

This paper discusses the experiences of community businesses (micro, small and medium-sized enterprises and smallholder farmers) in their use of and access to energy. It aims to give a better understanding of the finance needs of community businesses using PUE, and explores opportunities for unlocking affordable access to finance.

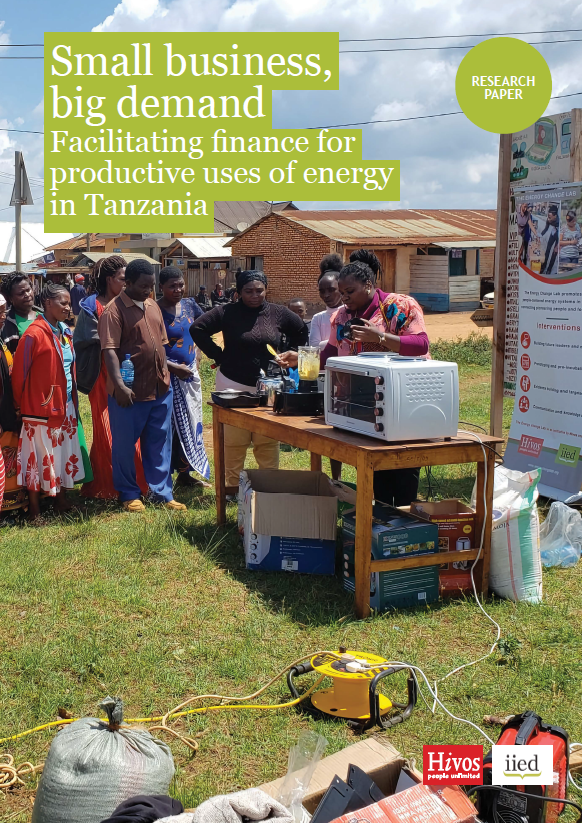

The study focuses on Tanzania, building on experience from the Energy Change Lab, a joint initiative of IIED and Hivos that seeks to create a sustainable and people-centred energy system. We surveyed 373 rural businesses and farmers—all customers of six energy companies in Tanzania—to understand their perceptions and challenges around financing for small businesses and PUE. According to our survey, challenges in accessing finance include: high interest rates; lengthy loan processes; unsuitable repayment periods; high collateral requirements; and uncertainty about ability to repay. Unsurprisingly, most people used their savings to start and expand their businesses. These findings highlight aspects of risk aversion and incompatible financing options for rural areas. Uncertainty in ability to repay was particularly pronounced in women, underlining negative gender beliefs and perceptions. Many entrepreneurs who had never borrowed before did not see a need to, which shows that more financing is not necessarily always the solution. And finally, for those willing to borrow, COVID-19 does not seem to have so far greatly affected perceptions of borrowing, which bodes well for short-term PUE investments. Moving PUE forward will require a delicate balance of tailoring and scaling by listening to each community’s unique challenges and needs. Some communities may require more affordable and flexible financing. This could include scaling financial products such as micro-leasing and linking existing funds or capitalising new ones to expand well-run community lending structures such as SACCOs.

Particular care should be taken in designing solutions that solve rather than exacerbate existing gender disparities: support beyond financing through empowerment and business training, for example. Energy providers must build partnerships with government, finance institutions, communities and other stakeholders to successfully nurture PUE.